Truth Seeker

New Member

Colorado and Washington may have voted to legalize recreational marijuana, but it is far from a green light for banks to provide accounts or other services to the pot industry in those states.

Financial institutions across the country still face legal risks if they do business with marijuana shops because pot remains illegal under federal law.

"If financial institutions are federally licensed or insured, they must comply with federal regulations, and those regulations are clear about conducting financial transactions with money generated by the sale of narcotics," said Jim Dowling, a former Internal Revenue Service special agent who also acted as an anti-money laundering advisor to the Office of National Drug Control Policy.

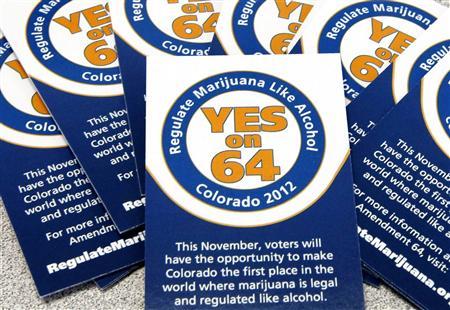

The ballot measures on Tuesday made Colorado and Washington the first states to permit recreational marijuana sale and use. Medical-marijuana laws have been around in some states for more than a decade.

California was the first state to legalize medical marijuana in 1996. With the addition of Massachusetts, which passed a medical-marijuana ballot initiative on Tuesday, 18 states and the District of Columbia now have such laws on their books.

The medical marijuana business was worth $1.7 billion in 2011 and growing, according to a study by financial-analysis firm See Change Strategy.

The federal government does not recognize states' authority to legalize marijuana under any circumstances, however. It has targeted some medical-pot businesses for violations of the 40-year-old Controlled Substances Act, which classifies the drug a Schedule 1 narcotic, meaning it is considered addictive and with no medical value.

The Justice Department on Wednesday said its marijuana enforcement policies remained unchanged. "We are reviewing the ballot initiatives and have no additional comment at this time," its public statement said.

A Justice Department spokeswoman did not respond to a request for additional comment related to banking activity.

DEA WARNS BANKS

Under President Barack Obama, federal authorities have focused enforcement efforts on large commercial medical marijuana operations that generate a lot of money. In some cases, federal money-laundering and forfeiture laws have been used against such businesses.

The U.S. Drug Enforcement Administration (DEA) began warning banks and credit card companies away from medical marijuana businesses four years ago, and many, if not all, have responded by closing the businesses' accounts. Even small regional banks that once publicly embraced the industry have abandoned it.

Some medical marijuana businesses pose as traditional medical clinics to open bank accounts, or clandestinely misuse existing personal or business accounts.

U.S. attorneys offices in states with medical marijuana laws have had a large degree of autonomy in determining when to bring criminal prosecutions for marijuana-related infractions of the Controlled Substances Act.

In 2010, Californians considered legalizing the recreational use of marijuana. While the measure ultimately failed, prior to the vote U.S. Attorney General Eric Holder vowed to aggressively prosecute "organizations that possess, manufacture or distribute marijuana for recreational use".

After Tuesday's votes, the Justice Department and individual U.S. attorneys offices will have to clarify their intentions with regard to enforcing the federal marijuana ban in Colorado and Washington, former federal enforcement officials said.

The recreational marijuana measures in both states will allow pot to be sold at state-licensed stores.

However, former Justice Department officials said that financial institutions, even those in Colorado and Washington State risk possible criminal or civil penalties for doing business with pot shops.

Once the states have begun their licensing processes, financial institutions may need to update their reviews on existing business customers by ensuring they are not on lists of state-licensed marijuana stores, the sources said.

News Hawk- TruthSeekr420 420 MAGAZINE

Source: reuters.com

Author: Brett Wolf

Contact: Thomson Reuters | Contact Us

Website: Pot legalization puts bankers in a pickle | Reuters

Financial institutions across the country still face legal risks if they do business with marijuana shops because pot remains illegal under federal law.

"If financial institutions are federally licensed or insured, they must comply with federal regulations, and those regulations are clear about conducting financial transactions with money generated by the sale of narcotics," said Jim Dowling, a former Internal Revenue Service special agent who also acted as an anti-money laundering advisor to the Office of National Drug Control Policy.

The ballot measures on Tuesday made Colorado and Washington the first states to permit recreational marijuana sale and use. Medical-marijuana laws have been around in some states for more than a decade.

California was the first state to legalize medical marijuana in 1996. With the addition of Massachusetts, which passed a medical-marijuana ballot initiative on Tuesday, 18 states and the District of Columbia now have such laws on their books.

The medical marijuana business was worth $1.7 billion in 2011 and growing, according to a study by financial-analysis firm See Change Strategy.

The federal government does not recognize states' authority to legalize marijuana under any circumstances, however. It has targeted some medical-pot businesses for violations of the 40-year-old Controlled Substances Act, which classifies the drug a Schedule 1 narcotic, meaning it is considered addictive and with no medical value.

The Justice Department on Wednesday said its marijuana enforcement policies remained unchanged. "We are reviewing the ballot initiatives and have no additional comment at this time," its public statement said.

A Justice Department spokeswoman did not respond to a request for additional comment related to banking activity.

DEA WARNS BANKS

Under President Barack Obama, federal authorities have focused enforcement efforts on large commercial medical marijuana operations that generate a lot of money. In some cases, federal money-laundering and forfeiture laws have been used against such businesses.

The U.S. Drug Enforcement Administration (DEA) began warning banks and credit card companies away from medical marijuana businesses four years ago, and many, if not all, have responded by closing the businesses' accounts. Even small regional banks that once publicly embraced the industry have abandoned it.

Some medical marijuana businesses pose as traditional medical clinics to open bank accounts, or clandestinely misuse existing personal or business accounts.

U.S. attorneys offices in states with medical marijuana laws have had a large degree of autonomy in determining when to bring criminal prosecutions for marijuana-related infractions of the Controlled Substances Act.

In 2010, Californians considered legalizing the recreational use of marijuana. While the measure ultimately failed, prior to the vote U.S. Attorney General Eric Holder vowed to aggressively prosecute "organizations that possess, manufacture or distribute marijuana for recreational use".

After Tuesday's votes, the Justice Department and individual U.S. attorneys offices will have to clarify their intentions with regard to enforcing the federal marijuana ban in Colorado and Washington, former federal enforcement officials said.

The recreational marijuana measures in both states will allow pot to be sold at state-licensed stores.

However, former Justice Department officials said that financial institutions, even those in Colorado and Washington State risk possible criminal or civil penalties for doing business with pot shops.

Once the states have begun their licensing processes, financial institutions may need to update their reviews on existing business customers by ensuring they are not on lists of state-licensed marijuana stores, the sources said.

News Hawk- TruthSeekr420 420 MAGAZINE

Source: reuters.com

Author: Brett Wolf

Contact: Thomson Reuters | Contact Us

Website: Pot legalization puts bankers in a pickle | Reuters