Truth Seeker

New Member

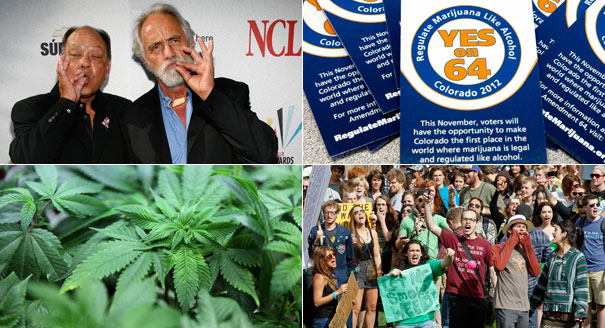

Now that voters in Colorado and Washington have legalized recreational marijuana use, dope smokers there can light up without the usual paranoid fear that the cops are at the door.

The taxman is another matter.

Cash-starved legislators are seeing dollar signs in dime bags – with talk that a tax on marijuana could pump hundreds of millions or even billions into budgets still reeling from the recession.

"I've seen some estimates in the high tens of millions, as much as $100 million for [Colorado]," said Rep. Jared Polis (D-Colo.), who's pushing a federal legalization in Congress. Money like that could make a big difference, he said – including a "substantial dent in needed school improvements, particularly in poorer districts."

It's long been a central argument of the pro-marijuana crowd: Get marijuana out of the hands of dope dealers, tax it like you do cigarettes, then sit back and watch the money pour in.

"We all know where the money from nonmedical marijuana sales is currently going," said a narrator in a Colorado campaign ad from last year, nodding to Mexico. "It doesn't need to be that way. If we pass Amendment 64, Colorado businesses would profit, and tax revenues would pay for public services and the reconstruction of our schools."

Dale Gieringer, director of California National Organization for the Reform of Marijuana Laws, estimates that legalizing pot would bring in at least $1.2 billion to his state alone. His study assumes a traditional sales tax plus an additional $50 levy per ounce of marijuana, which runs between $280 and $420.

His study argues that legalization could also generate $12 billion to $18 billion in new economic activity for California.

The skeptics' response: What are you smoking?

"This is not a cash cow that can solve anyone's fiscal problems," said Harvard economics professor Jeffrey Miron, a pro-legalization scholar at the libertarian Cato Institute who says Gieringer's numbers are roughly three times what they should be.

"There is a lot of exaggeration about how big the revenue can be."

Advocates "want to be allowed to smoke in peace," Miron said. But, they're "nervous about making that argument. They're afraid that argument won't win the day, so they have focused in many cases on the revenue side."

Miron estimates that a nationwide legalization that taxed marijuana like alcohol and tobacco would mean $6.4 billion in new tax revenue – $4.3 billion for Uncle Sam and $2.1 billion for the states.

The estimates are necessarily hazy. No one knows how much marijuana is bought and sold today, let alone how legalization will affect consumption and prices.

"When you go to legalize, you have reduced risk in producing and distributing the drug. That's a real component of the monetary price of marijuana," said Rosalie Liccardo Pacula, the co-director of the RAND Drug Policy Research Center.

She expects prices to fall by 70 to 85 percent in both Colorado and Washington – and that means taxes, if levied as a percentage of price or value, will also fall considerably.

But she acknowledges that it's hard to know for sure.

"You have to know more about the structure of the demand curve, which we don't have any data on because this is black-market; it's all conjecture," Liccardo Pacula said.

And even lawmakers looking to cash in know they've got to be careful. Tax marijuana too much and it drives users right back to illegal dealers. Nobody knows what that price point is.

"You want to make sure the black market doesn't have an advantage over the regulated market because if it does, then the whole concept fails and people will continue to buy marijuana illegally – so there has to be a price advance for the legal market," Polis said.

News Hawk- Truth Seeker 420 MAGAZINE ®

Source: politico.com

Author: Rachael Bade

Contact: Contact Us - POLITICO

Website: Cash-starved states eye pot tax - Rachael Bade - POLITICO.com

The taxman is another matter.

Cash-starved legislators are seeing dollar signs in dime bags – with talk that a tax on marijuana could pump hundreds of millions or even billions into budgets still reeling from the recession.

"I've seen some estimates in the high tens of millions, as much as $100 million for [Colorado]," said Rep. Jared Polis (D-Colo.), who's pushing a federal legalization in Congress. Money like that could make a big difference, he said – including a "substantial dent in needed school improvements, particularly in poorer districts."

It's long been a central argument of the pro-marijuana crowd: Get marijuana out of the hands of dope dealers, tax it like you do cigarettes, then sit back and watch the money pour in.

"We all know where the money from nonmedical marijuana sales is currently going," said a narrator in a Colorado campaign ad from last year, nodding to Mexico. "It doesn't need to be that way. If we pass Amendment 64, Colorado businesses would profit, and tax revenues would pay for public services and the reconstruction of our schools."

Dale Gieringer, director of California National Organization for the Reform of Marijuana Laws, estimates that legalizing pot would bring in at least $1.2 billion to his state alone. His study assumes a traditional sales tax plus an additional $50 levy per ounce of marijuana, which runs between $280 and $420.

His study argues that legalization could also generate $12 billion to $18 billion in new economic activity for California.

The skeptics' response: What are you smoking?

"This is not a cash cow that can solve anyone's fiscal problems," said Harvard economics professor Jeffrey Miron, a pro-legalization scholar at the libertarian Cato Institute who says Gieringer's numbers are roughly three times what they should be.

"There is a lot of exaggeration about how big the revenue can be."

Advocates "want to be allowed to smoke in peace," Miron said. But, they're "nervous about making that argument. They're afraid that argument won't win the day, so they have focused in many cases on the revenue side."

Miron estimates that a nationwide legalization that taxed marijuana like alcohol and tobacco would mean $6.4 billion in new tax revenue – $4.3 billion for Uncle Sam and $2.1 billion for the states.

The estimates are necessarily hazy. No one knows how much marijuana is bought and sold today, let alone how legalization will affect consumption and prices.

"When you go to legalize, you have reduced risk in producing and distributing the drug. That's a real component of the monetary price of marijuana," said Rosalie Liccardo Pacula, the co-director of the RAND Drug Policy Research Center.

She expects prices to fall by 70 to 85 percent in both Colorado and Washington – and that means taxes, if levied as a percentage of price or value, will also fall considerably.

But she acknowledges that it's hard to know for sure.

"You have to know more about the structure of the demand curve, which we don't have any data on because this is black-market; it's all conjecture," Liccardo Pacula said.

And even lawmakers looking to cash in know they've got to be careful. Tax marijuana too much and it drives users right back to illegal dealers. Nobody knows what that price point is.

"You want to make sure the black market doesn't have an advantage over the regulated market because if it does, then the whole concept fails and people will continue to buy marijuana illegally – so there has to be a price advance for the legal market," Polis said.

News Hawk- Truth Seeker 420 MAGAZINE ®

Source: politico.com

Author: Rachael Bade

Contact: Contact Us - POLITICO

Website: Cash-starved states eye pot tax - Rachael Bade - POLITICO.com