- Relatives of late stoner Jerry Garcia pull his cannabis brand out of Golden State as high taxes and regulation sees profits dive – and the black market surge

- California has collected more than $4billion in taxes from legal cannabis sales

- Regulations have made it difficult for legitimate weed business to be profitable

- Experts predict that scores of legal California sellers could go bust in 2023

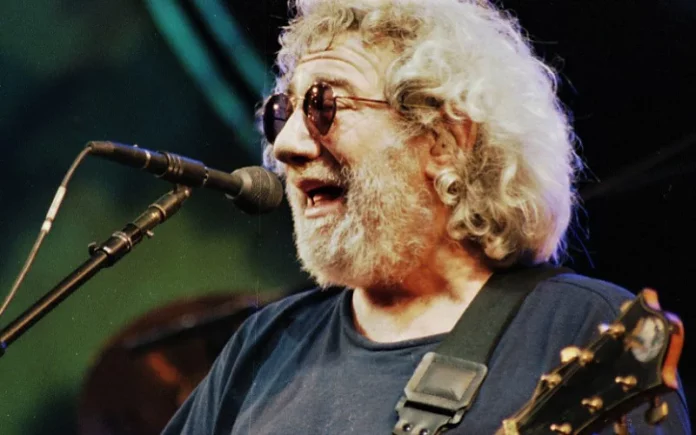

A marijuana brand bearing the name of Jerry Garcia, one of the world’s most famous stoners, has pulled out of California as the state’s cannabis taxes gut legal operations and allow the black market to thrive.

Garcia Hand Picked – founded by the relatives of Grateful Dead guitarist Jerry Garcia – removed its products and operations from California as the state’s laws coupled with Federal taxes have left legitimate producers paying as much as 80 percent in taxes.

As businesses jump through hurdles to produce and sell marijuana, black market operations and illegal farms have managed to operate without legal barriers and undercut the efforts of legitimate markets.

The pull out of Garcia Hand Picked comes as experts have predicted scores of marijuana businesses could go bust in California as years of operating at losses to keep ahead of regulations comes to a head.

California legalized the production and sale of cannabis in 2016, but since then the path to profit has been crossed with regulatory red tape.

Required retail licenses can cost up to $100,000 per year to hold, and businesses are taxed up to 25 percent per retail sale.

Federal laws also prevent companies from deducting business taxes from federal taxes, leading to exorbitant taxes paid across the board.

From 2017 to 2022, California also charged a cultivation tax billing farmers by the square footage of their farms instead of the actual yield of their product, which allowed large corporate farms to thrive gutted small producers.

Since cannabis was legalized in California, the state has collected at least $4billion, according to Marijuana Moment.

While brands like Garcia Hand Picked struggled to follow the rules, illegal operations have been able to steal much of the market in California.

Operating without the costs of regulatory fees and taxes, black market weed producers and shops have been able to sell their products at a serious markdown compared to their legal competitors.

In the years after legalization, up to 80 percent of the marijuana sold in California was still purchased from illegal sources, according to Forbes.

Illegal storefronts have operated with near impunity, as the repercussions for getting caught are often no more severe than misdemeanors.

Sheriff’s Department’s Narcotics Bureau Lieutenant Howard Fuchs of the told the Los Angeles Times that authorities don’t bother prosecuting heavily if crimes are limited to selling cannabis.

‘There’s this attitude: It’s just cannabis, we’re not going to incarcerate people for that,’ he said. ‘Well, you’re just telling the legal market, ‘Good luck.’

Jerry Garcia was a born and bred Californian, and throughout his life became a pivotal cultural figure in the normalizing of marijuana use. For his family, basing their cannabis business in California was only natural.

‘This was a hard decision for them, they love California,’ cannabis consultant Andrew DeAngelo told SFGate. ‘They were born and bred here. This is very painful for them, I guarantee that.’

DeAngelo said the departure of a celebrity brand as prominent as Garcia Hand Picked was a grim sign of the times in the California market.

‘You can’t make any money in this market,’ he said. ‘Not only is Garcia leaving, a lot of people are leaving.’

In the years after legalization, up to 80 percent of the marijuana sold in California was still purchased from illegal sources, according to Forbes

The president of United Cannabis Business Association, Jerred Kiloh, gave a grim prediction for the California cannabis market’s future, arguing that years of debt assumed while keeping up with taxes and regulation fees was coming to a head.

‘It’s probably ballooning quickly now, because people have no dollars left, and there isn’t a light at the end of the tunnel, and no one’s investing,’ he said, according to Green Market Report.

President of the San Francisco distributor Grizzly Peak, Matt Yamashita, gave a similar prediction in blunter terms, saying ‘It’s going to be a mass extinction event here shortly.’

‘In the next 12 months, I think half the retailers are going to be in business. I think 80% of the people in business will be gone. It’s inevitable. The bubble is going to burst,’ he said.

Other markets like New York City face similar barriers to success from regulation and threats to their market share from black market sellers.

Though fully licensed shops have only just begun to arrive in NYC, countless storefronts have already begun operating and cashing in on legalization.

Much like the illegal operations in California, those storefronts have been able to offer their product at a vastly cheaper price point than above-board shops are able to compete with.

In December, a researcher for cannabis intelligence group New Frontier Data, Amanda Reiman, said illegal shops were already ‘taking a pretty hefty percent of the potential market share,’ even though no legal stores had even had a chance to open.

‘When you have dispensaries and distribution systems that pretty much mimic regulated markets, it can be really difficult to get people to move over,’ she said, adding eliminating illegal businesses without harsh legal recourse was like ‘whack-a-mole.’

‘If one goes down, another one just pops up,’ she told CNBC.

NYC Mayor Eric Adams has vowed not to let black markets ruin the legal trade.

‘We will not let the economic opportunities that legal cannabis offers be taken for a ride by unlicensed establishments,’ he said last month.