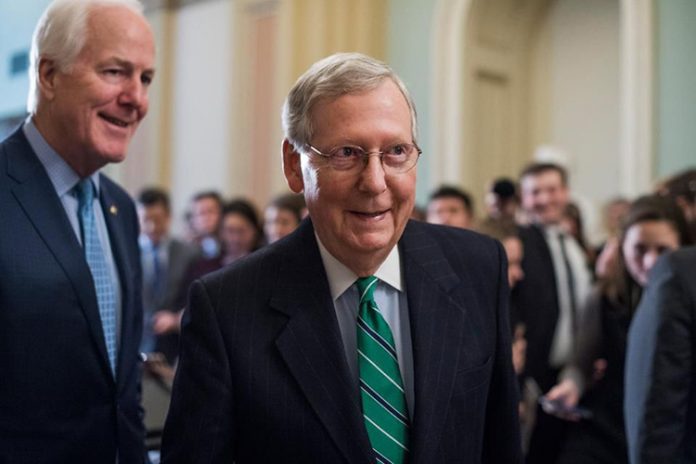

The North American Marijuana Index retreated on Tuesday, as pot stocks lost ground following Monday’s brief respite from the downward spiral. Not unexpectedly, Senate Majority Leader Mitch McConnell (R-Kentucky) announced his continued support for cannabis prohibition, dashing the hopes of weed stock investors everywhere who foolishly misread the political tea leaves in recent weeks. Like an emotionally abusive relationship, investors have become wont to the misdeeds and pitiful glances of government officials that dangle legalization in one hand only to ghost the idea moments later.

McConnell’s recent push to legalize hemp nationwide was hailed by many as a stepping stone towards the end of prohibition, with pot stock investors giddily anticipating a sharp rise in the market. Yet, with Senate Minority Leader Chuck Schumer (D-New York) pushing a decriminalization bill, McConnell announced on Tuesday that he does “not have any plans to endorse legalization of marijuana.”

“These are two entirely separate plants,” McConnell said, as reported by The Washington Examiner. “I hope everybody understands that. It is a different plant. It has an illicit cousin which I choose not to embrace.”

While blindsided analysts continue to highlight the positive news from Washington —Senator Gardner’s deal with Trump, Schumer’s decriminalization bill, McConnell’s hemp push —they ignore the equally negative reactions from both an Administration and GOP that has proven time and again to be on the wrong side of history. For every hemp bill, there is a ruling by the Small Business Administration banning loans in the marijuana sector. Investors suffer and marijuana stocks fall.

As for hemp, McConnell considers it a “diversified crop” that could benefit farmers across the country. The Index fell 3.86 points, or 1.58 percent to close out the day at 240.88, with The United States Marijuana Index falling 0.72 percent and The Canadian Marijuana Index dropping 1.89 percent.

Proof positive of the erratic nature of America’s current leadership, President Trump today announced the United States would withdraw from the Iran nuclear deal, sending energy stocks rising and causing Wall Street to end the day mixed. Most experts expect the move will result in wider conflict in the Middle East, increased tensions with European allies, and rising oil prices. Trump stated his willingness to renegotiate with Tehran, though previous actions by the administration put serious doubts on that possibility.

“You have seen some modest flight to quality, though it hasn’t been major,” said Brian Daingerfield, macro strategist at NatWest Markets in an interview with Reuters. “There’s still quite a bit of uncertainty about the future of the deal even now that the U.S. has made its intentions clear.”

The Dow Jones Industrial Average rose 0.01 percent to end the day at 24,360.21, while the S&P 500 fell 0.03 percent to 2,671.92. Meanwhile, the Nasdaq Composite rose 0.02 percent to close out the day at 7,266.90.

The Horizons Marijuana Life Sciences ETF fell CAD$0.18 per share, a loss of 1.08 percent, to close out the day at CAD$16.55, while the Evolve Marijuana ETF dropped CAD$0.28 per share, or 1.70 percent to close out the day at CAD$16.19.

GW Pharmaceuticals Falls Short In Second Quarter Earnings

GW Pharmaceuticals reported an earnings loss for the second quarter despite positive news surrounding their flagship pharmaceutical, the cannabidiol-based drug Epidiolex. Although there was good news in terms of revenue, the company missed on earnings by a large margin. According to reports, the U.K. firm lost $3.12 a share on $3.35 million in sales.

Epidiolex made waves earlier this year when the drug was approved by an FDA Advisory Committee, setting it up for full approval later this summer. The drug is targeted at children suffering from Dravet syndrome and Lennox-Gastaut syndrome, two severe forms of childhood epilepsy. Company CEO Justin Gover hopes that FDA approval will help to push the company into the marijuana stock stratosphere.

“The strength and consistency of the clinical data, together with the public presentations that featured very moving personal stories of the challenges associated with managing these difficult forms of epilepsy, led to a unanimous vote in support of approval,” Gover remarked in a statement. “With our late June FDA decision date nearing, our commercial team is busy preparing to launch Epidiolex in the second half of this year.”

GW Pharmaceuticals has a market cap near $4 billion and trades at around $140 per share.

Wholesale Cannabis Prices Continue To Drop

Oregon may become a test-case for the country at-large, as reports surfaced this week that wholesale cannabis prices are falling all across the United States. According to the Cannabis Benchmarks U.S. Spot Index, the national average price for a pound of cannabis has dropped to $1,562 from a high of $1,789 in 2016, a loss of 13 percent.

In Oregon, prices have fallen nearly 40 percent, forcing many locals shops to lay off staff and close their doors for good. Experts believe any number of possible reasons, including what Willamette Weekly listed as, “an unpredictable market, oversaturation and even corporate consolidation in the industry.”

Marijuana Tax Revenue Hits Below Expectations

A new report by Moody’s states that marijuana sales may not benefit states as much as some government officials may hope. Even in states where the retail market for weed is well established, for example like Nevada, tax revenue has yet to meet expectations. Watch more on the issue below: