Cronos Group, a medical marijuana company based in Toronto, just became the first Canadian cannabis stock to trade on a U.S. exchange. The stock is trading under ticker symbol CRON on the NASDAQ, and started trading yesterday at $8.24 before closing the day at $7.62. The stock closed up 20% today at $9.17.

Cronos was previously trading as an American Depository Receipt on the OTC markets with the ticker symbol PRMCF. It is part of the first marijuana ETF to trade on a U.S. exchange, the ETFMG Alternative Harvest ETF, where it is the top holding, comprising 9.18% of the fund.

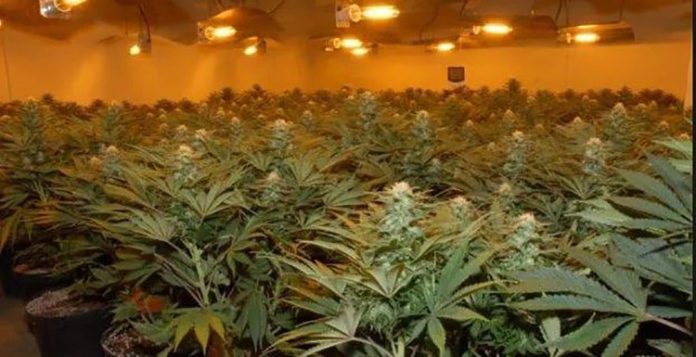

Cronos owns 100% of two medicinal marijuana and cannabis oil brands: Peace Naturals, which has 95 acres of land in Ontario; and Original BC, which has 31 acres of land in British Columbia. The company also holds a 21.5% stake in Whistler Medical Marijuana Company.

The company announced a joint venture agreement with Kibbutz Gan Shmuel in Israel, a partnership that will aid cultivation and distribution by leveraging the operations of the long-established kibbutz. According to a press release from last September, “The Israeli climate, combined with Gan Shmuel’s existing manufacturing infrastructure and skilled labor force, will enable Cronos Israel to produce high quality medical cannabis at an expected cost of between $0.40 and $0.50 per gram.”

While the NASDAQ listing is a new and exciting development for many investors, does that mean that Cronos Group is a good investment?

Marijuana, along with cryptocurrency, is currently one of the hottest industries for investors. Just like crypto, marijuana stocks offer high rewards with high risks alongside the accompanying volatility.

There are some key potential regulatory tailwinds that could rapidly enhance the growth prospects for Cronos and other marijuana companies. Canada is expected to legalize the use of recreational marijuana this year. Medicinal and recreational use of marijuana is becoming more accepted in the United States, with eight states allowing recreational use and more states expected to vote for legalization this year.

There are some significant headwinds, however, that could impede progress. Marijuana is still prohibited in the United States on a federal level, both for medicinal and recreational purposes. Attorney General Jeff Sessions created controversy at the beginning of the year by rescinding the Obama-era “Cole memo,” which encouraged federal prosecutors to turn a blind eye towards cracking down on marijuana-related operations.

On a financial level, the company is burning through cash, which is not unusual for a biotech growth stock. TTM free cash flow is -$23.21 million compared to -$8 million in 2016, while TTM capital spending is -$18.44 million compared to -$1.52 million in 2016. Debt/equity ratio is low, at only 0.07, so it is not using leverage to increase earnings (Note that all financial data is sourced from Morningstar, and 2017 fourth quarter earnings have not yet been released).

A potential red flag for investors is that the amount of shares outstanding has dramatically increased from 12.75 million in 2013 to 134.79 million TTM. By continuing to raise offerings, shareholders will find their shares diluting in value as the company tries to raise more cash.

The impending legalization of marijuana in Canada and the United States, as well as the availability of NASDAQ-traded shares, could make the company appealing to investors interested in cannabis. As always, chasing investing trends without doing proper research can lead to significant losses.